Manage client journey through a digital customer intake process and automatic professional analysis, in real time. From the stage of interest to making a professional and high-quality decision for you and the client.

create in a few minutes a professional loan request, then submit/sent the request to as many funding institutes as you like and find out which one is best suits for your loan terms and needs.

To enable sagole to recognize and analyze your business, you can upload standard business documents typically required for any business assessment or analysis. Don't worry, you can upload just a portion of the documents initially and add more as needed. Not sure which documents to upload? Feel free to involve your accountant and invite them to upload documents on your behalf.

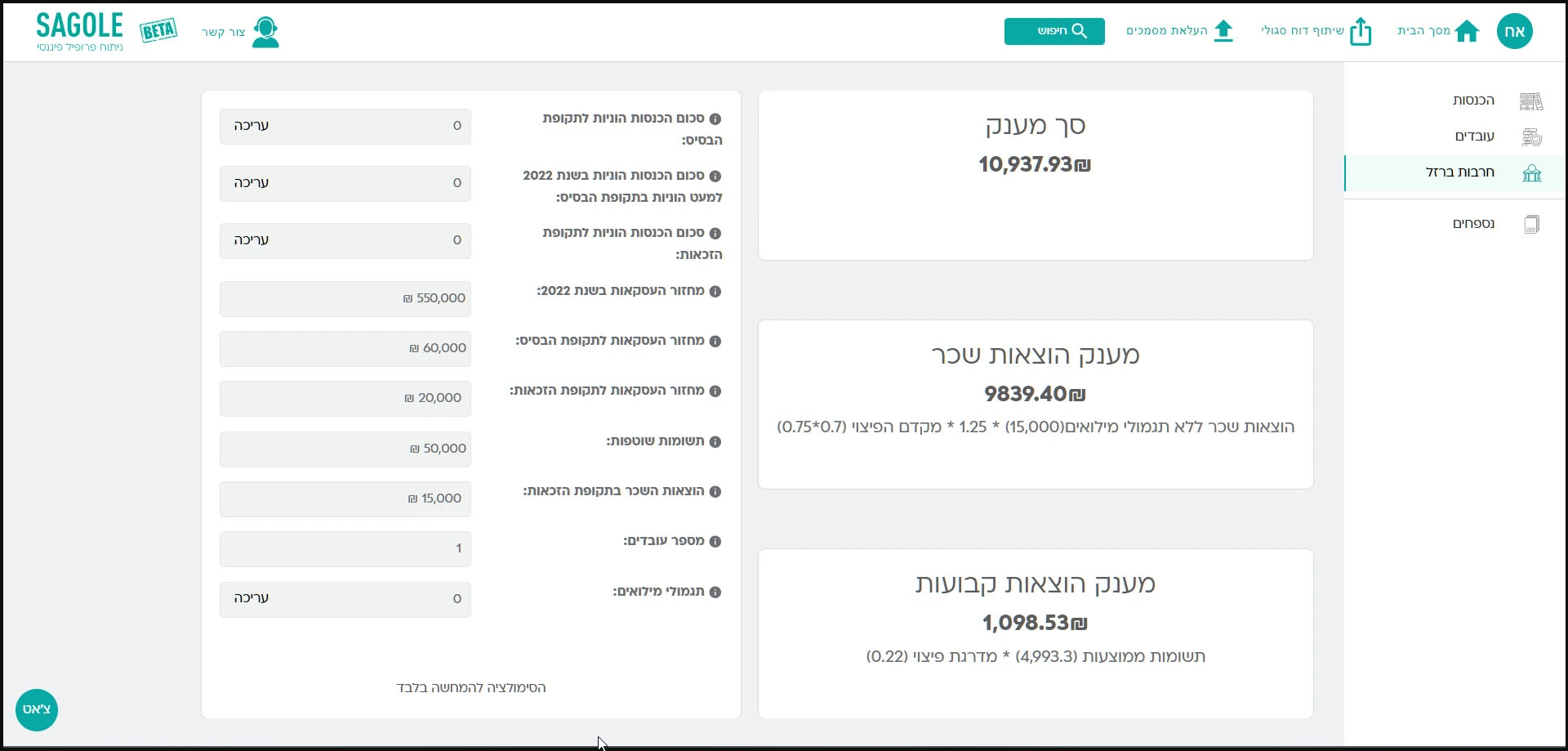

Following document upload, sagole will provide you with a user-friendly management interface. Here, you can gain valuable insights into your business operations, identify key trends, assess financial stability, and much more. This interface can be shared with colleagues, partners/investors, and even your financing provider for viewing purposes.

After generating your management interface, you can produce a variety of reports that save you significant time and effort. For example, you can create a professional and well-reasoned credit application that will help you secure the financing you need from your bank. And, coming soon, you'll be able to generate business valuations for various purposes, access AI-powered business predictions, and utilize our benchmarking platform to compare your business to others.

בימים בהם עסקים רבים חווים קושי כלכלי משמעותי ולא יכולים להרשות לעצמם להיעזר בשירותי ייעוץ פיננסי, מוצעת מערכת SAGOLE שתחשב עבור כל בעל עסק במדויק את סכום המענק שהוא זכאי לקבל, בזמן אמת ובחינם

מתווה הפיצויים המורכב שהציעה המדינה לעסקים שנפגעו במלחמה זכה לביקורת רבה • מערכת מקוונת חדשה בשם סגולי של ירין ברק ורוני פרפורי מציעה לסייע לעסקים בחישוב המענקים

עסקים רבים חווים כעת תקופה מאתגרת ובהתאם לכך הוחלט בישראל לפתוח את SAGOLE - מערכת ניתוח פרופיל פיננסי ישראלית ראשונה מסוגה. המערכת תהיה חינמית לחלוטין לכולם עד ה-30 בינואר 2024

Using the analysis you received, you can take advantage of our various features and bring cutting-edge technology to your business. For instance, you can generate a professional loan application and submit it to any lender of your choice.

Absolutely. sagole will generate a sophisticated and user-friendly management interface that incorporates information from the documents you have uploaded. You can upload additional documents at any time, and your management interface will update automatically. You can also click “Share Upload” and invite your accountant to upload documents on your behalf.

We understand your concern. It’s important to note that we maintain the highest regulatory standards and practices for storing and securing user documents.

sagole is perfect for professionals who need to gather documents and analyze information quickly and professionally. sagole will do this for you in real-time, saving you significant time and effort.

In an upcoming version, we will enable integration with bank accounts using open banking. We’re working on it.

Absolutely. Simply invite the business owners to upload the relevant documents, and you will receive a comprehensive analysis of the business you’re looking to acquire, including profitability, financial ratios, repayment capacity, and more.

Absolutely. Simply invite the business owners to upload the relevant documents, and you will receive a comprehensive analysis of the business you’re looking to acquire, including profitability, financial ratios, repayment capacity, and more.

sagole is suitable for financial institutions that provide services to a large number of businesses, such as loan providers, business consulting firms, outsourced finance managers, and more.

With the sagole system, you can collect documents digitally. sagole will catalog and extract relevant information from the documents, making it accessible for quick and informed decision-making.

The sagole system is designed to enable financial institutions to acquire a larger volume of clients in less time and without investing in additional manpower and associated resources.

We are experienced in integration and can interface with all management systems within your organization.

We have an excellent partnership program. Feel free to leave your details on our partnership page, and we will gladly get back to you.